30+ Front end debt to income ratio

The debt ratio is defined as the ratio of total debt to total assets expressed as a decimal or. 1500 5000 x 100 30.

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR.

. Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower. How To Calculate Your Front End Debt-To-Income Ratio DTI Front End Ratio Example Amount. The loan is secured on the borrowers property through a process.

This might be very stressing due to inadequate time to do a thorough research to come up with a quality paper. Initially this recapitalization was accounted for as a debt increase that elevated the debt-to-GDP ratio by 248 points by the end of 2012. For example in mortgage lending in the United States a debt-to-income ratio typically includes the cost of mortgage payments as well as insurance and property tax divided by a consumers monthly income.

In return for this the government received shares in those banks which it could later sell per March 2012 was expected to generate 16bn of extra privatization income for the Greek government to be. The debt ratio is a financial ratio that measures the extent of a companys leverage. The percentage of your income to cover all your debt obligations including housing costs student loans car loans credit card payments child support and other debts.

If monthly mortgage payment insurance taxes and fees equals 2000 and monthly income equals 6000 the front-end ratio would be 30 2000 divided by 6000. Thats your current debt-to-income ratio. Lowering your credit utilization ratio will help boost your credit.

There are two main forms of debt-to-income ratios. Say your total aggregate monthly debt excluding non-debt expenses is 1500. Your mortgage property taxes and homeowners insurance is 2000.

As of September 30 2012 the total debt was 161 trillion with debt held by the public of 113 trillion and. Front-end looks at the relationship between. Debt-To-Income Ratio Annual Debt RepaymentsGross Income x 100.

Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month. There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643. A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income.

Lenders would like to see the front-end ratio of 28 or less for conventional loans and 31 or less for Federal Housing Association FHA loans. You can use the menus to select other loan durations alter the loan amount change your down payment or change your location. Government securities or other obligations held by investors eg bonds bills and notes while Social Security and other federal trust funds are part of the intra-governmental debt.

Harvard Professor now Senator Elizabeth Warren is known as a bankruptcy expert. Achiever Papers is here to save you from all this stress. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1.

The debt held by the public refers to US. The Federal Reserve System also known as the Federal Reserve or simply the Fed is the central banking system of the United States of AmericaIt was created on December 23 1913 with the enactment of the Federal Reserve Act after a series of financial panics particularly the panic of 1907 led to the desire for central control of the monetary system in order to alleviate financial. The following table shows current Redmond 30-year mortgage rates.

The ideal front-end ratio should not exceed 28. Some loan types require a look at two forms of DTI ratio. However borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score.

What is a debt-to-income ratio. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. In this example lets say that your monthly gross household income is 3000.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The following table shows the required income needed to have a 28 DTI front end ratio on a home purchase with 20 down for various home values. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

As a busy student you might end up forgetting some of the assignments assigned to you until a night or a day before they are due. USDA loans set their limit at 29 for front-end-ratio and 41 for back-end-ratio. Total Debt Service Ratio aka Front End Ratio This ratio is what lenders crunch when looking at how capable you are in servicing your housing debt.

The debt-to-income ratio is an underwriting guideline that looks at the relationship between your gross monthly income and your major monthly debts giving VA lenders an insight into your purchasing power and your ability to repay debt. The debt-to-income DTI ratio is a metric used by creditors to determine the ability of a borrower to pay their debts and make interest payments. Your debt-to-income ratio DTI measures your total income against any debt you have.

The ideal back-end ratio is. Your monthly gross income before taxes and household expenses is 4500. Heres a simple example.

The debt-to-income ratio is one. A front-end ratio of 28 or below together with a back-end ratio including required payments on non-housing debt as well of 36 or. Let our professional writers handle your.

Check out Moneys debt-to-Income ratio calculator. Divide 900 by 3000 to get 30 then multiply that by 100 to. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed.

However many lenders let borrowers exceed 30 and some even let borrowers exceed 40. Debt-To-Income Ratio - DTI. Learn what a good DTI is how to calculate it and how to lower it.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Cmbs Disputes On The Horizon April 2021 Quinn Emanuel Urquhart Sullivan Llp Jdsupra

How To Improve Your Credit Age Of Credit History Credit Com

Bank Debt Vs Corporate Bonds Comparison Of Features And Pros Cons

Ex 99 2

What Bills Are Calculated In The Debt To Income Ratio Quora

Mufg Union Bank Mortgage Rates 5 05 Review Details Origination Data

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Best Mortgage Calculator Osama Emara Mortgage Loan Originator

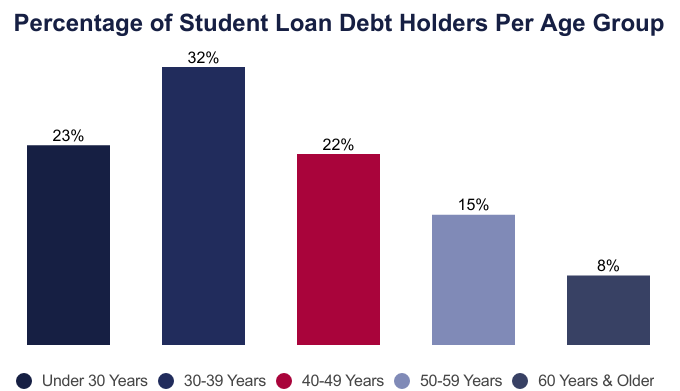

Average Student Loan Debt By Age 2022 Facts Statistics

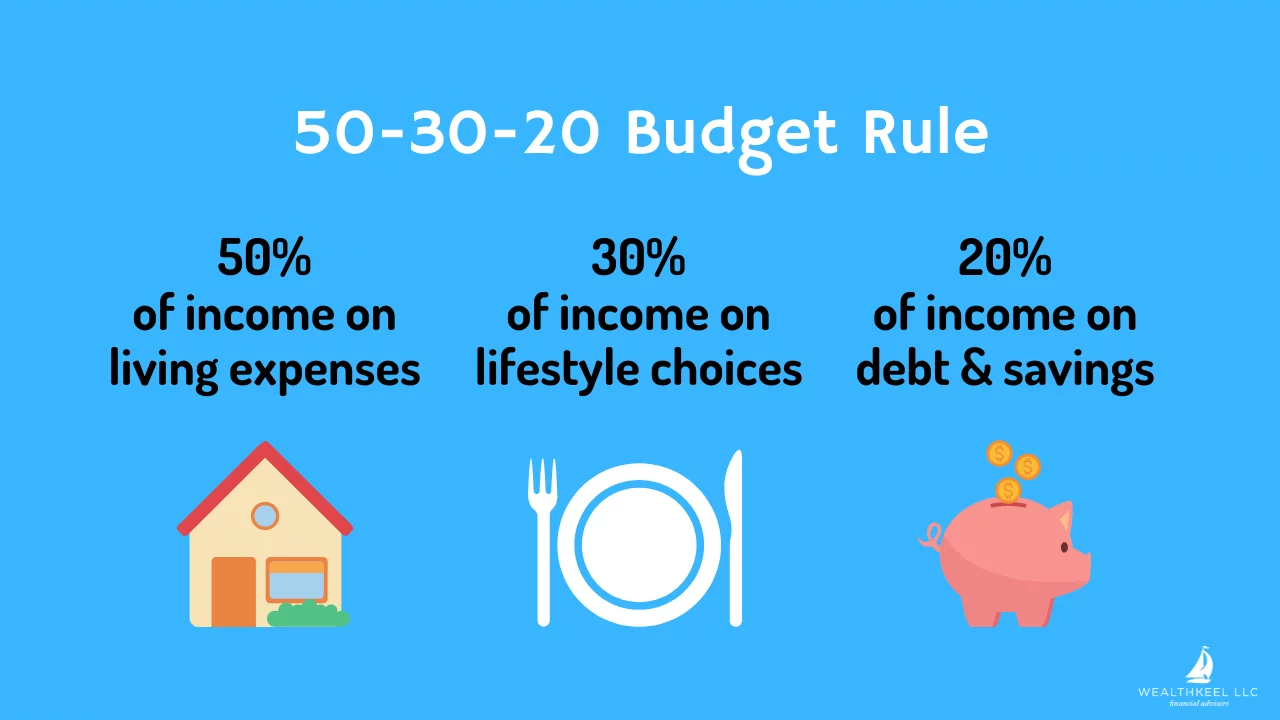

How Much Do I Need To Retire As A Physician Wealthkeel

What Bills Are Calculated In The Debt To Income Ratio Quora

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

How Much Should You Spend On That Life And My Finances